Are you across the changes to Superannuation?

UNPAID SUPERANNUATION

Date of effect – 1 July 2019

- The ATO can apply for court ordered penalties for employers who ignore or refuse directions to make compulsory superannuation guarantee contributions on behalf of their employees.

- STP Reporting now makes it much easier for the ATO to identify employer non-compliance.

If you are an EMPLOYER:

- Ensure that your superannuation contributions on behalf of your employees are up to date. Consider paying monthly to alleviate and smooth out cash flow.

- If you have overdue superannuation liability obligations, then speak with your bookkeeper or accountant about completing superannuation guarantee charge statements. If you are communicating with the ATO, then they will happily engage with you and support you in meeting your superannuation guarantee obligations.

- Consider accessing the Superannuation Amnesty provisions that will allow employers to self-correct historical Superannuation Guarantee non-compliance from 1 Jul 1992 to 31 March 2018 (further details below).

If you are an EMPLOYEE:

- You can check your member statement from your superfund or contact your super fund to confirm that your employer has paid your superannuation contributions.

- You will soon be able to keep track of this via your MyGov account as well. Currently, you can see contributions for prior financial years, and it is based on what has been reported directly from the super funds.

- Speak directly to your employer about payment of your superannuation contributions. If they fail to make the legally required contributions, then the employer can be reported directly to the ATO: Report Unpaid Super Contributions from my Employer

Superannuation Amnesty – The Treasury Laws Amendment (Recovering Unpaid Superannuation) Bill 2019

Date of effect – awaiting royal assent (received 10 Mar 2020)

- A one-off amnesty to encourage employers to self-correct historical Superannuation non-compliance between 1 Jul 1992 and 31 March 2018.

- Allows employers to claim tax deductions for payments of the SG charge or contributions made during the amnesty period, as well as removing the administrative component and the Part 7 penalty that may apply in relation to Superannuation Guarantee non-compliance.

- The amnesty period commences on 24 May 2018 and ended 6 months after royal assent (7 Sep 2020).

- This legislation will also impose minimum penalties on employers who fail to come forward during the amnesty period.

- To use the amnesty, all that is owed to employees, including the interest components must still be paid.

Superannuation and Salary Sacrifice

Date of effect – 1 Jan 2020

- Salary Sacrifice contributions cannot reduce the minimum amount of super guarantee that you must pay.

- Entering into a salary sacrifice arrangement will not reduce your employees’ ordinary time earnings base.

- Salary Sacrificing Super – ATO

High Income Earners – Multiple Employers

Date of effect – 1 Jan 2020

- Individuals with multiple employers can opt out of receiving Superannuation Guarantee from some of their employers to avoid unintentionally going over the concessional contributions cap.

-

Eligibility:

- Have more than one employer

- Expect the mandated concessional contributions to exceed your concessional contributions cap for a financial year

-

How to Apply:

- The application for an exemption certificate must be made by the employee (NAT75067)

- NAT75067 High Income Earners SG Exemption

- The exemption certificate will only be valid for 12 months.

- Until the exemption certificate is received, the employer must continue to meet their Superannuation Guarantee obligations.

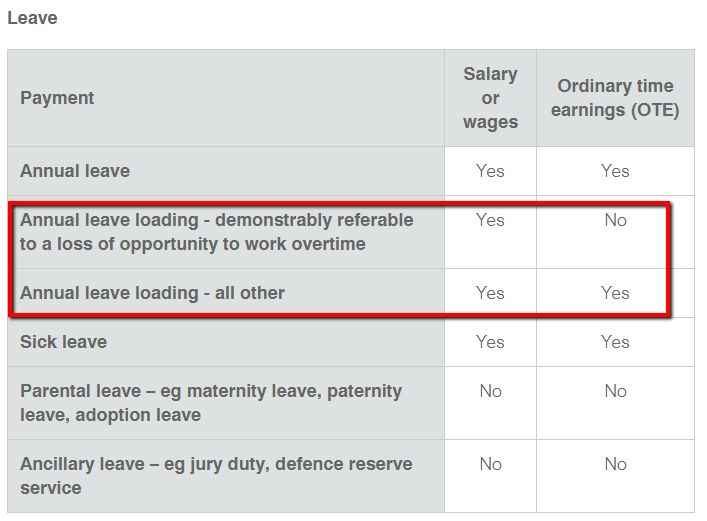

Superannuation on Annual Leave Loading

Date of effect – updated interpretation 9 June 2019

-

Annual Leave Loading is considered to be Ordinary Time Earnings (OTE) unless it is referable to a lost opportunity to work overtime:

- Generally specified in the award that Annual Leave Loading is compensation for overtime

- If not specified in the award, then it is considered Ordinary Time Earnings unless other evidence can be provided

- Most awards do not state the reason that Annual Leave Loading is provided

-

The ATO will not be applying compliance resources to scrutinise why Annual Leave Loading was paid in previous quarters, on the basis that:

- The employer self-assessed that Annual Leave Loading was not OTE with a reasonable position

- There is no evidence less than five years old suggesting otherwise

-

If reviewing prior quarters and it’s determined that Annual Leave Loading was not referable to a lost opportunity to work overtime, then an

employer will have an SG shortfall, and must lodge a Superannuation Guarantee Charge Statement.

ATO: Annual Leave Loading and OTE -

The ATO

Checklist: Salary or wages and ordinary time earnings

has now been updated to reflect this.

Superannuation Guarantee Percentage Increase

Date of effect – 1 July 2021

- The Superannuation Guarantee Percentage was 9.5% until 30 Jun 2021

- From 1 Jul 2021, it increased to 10%

- It will continue increasing 0.5% per year until it reaches 12%

If you are an employer, you need to consider the impact of these changes on your existing and future employment contracts:

- Your salary is $90,000, inclusive of super – your total package stays at $90,000 even with the super rate increase.

- Your salary is $90,000, plus super – your total package increases in line with the super rate.

If you are an employer, consider your pricing, budgets, and cashflow planning for these increases.

Any questions about these changes and how they may impact your business or employees? Contact us now

Leave a Comment